Malaysia Taxation Service

Hotline: 86-755-82143348, Email:anitayao@citilinkia.com

Tax filing is the process of preparing tax returns, often income tax returns, often for a company other than a person. Tax preparation may be done by the taxpayer with the help of a licensed professional such as licensed authorized company, certified public accountant or enrolled agent. Below refers to some common questions that are frequently asked:

Do I Need to File?

• You must file a federal income tax return if you own business transaction.

• The amount you owe varies depending on your filing status, age, the kind of income you have, and other factors.

• Answer some easy questions to see if you need to file.

How Do I File?

• Find a professional preparer.

• If you have employees, file employment taxes.

What If I File Late?

• Think your taxes won't be finished on time? File for an extension of time to file.

• Find out what can happen if you file late.

• Alternative payment plans are available.

In Malaysia, individuals and businesses can use e-Filing to carry out their annual tax assessment. Known in short as e-Filling, the Malaysian Inland Revenue Board ( IRB ) operates its online system through its e.hasil.gov.my website. Before preparing tax return, it is a must to do accounting, in term of means to accumulate and report on financial information about the performance, financial position, and cash flows of a business. After that, IRB rely on audited financial statements to determine the accuracy of tax returns filed by the companies.

On the other hand, for income earners with business income would need to submit their forms latest by the 30th of June each year. The same procedure will be applicable for both these income earner. However, business income earners might have to pay a lump sum to income tax as they might not have adopted the PCB method.

There are several types of forms that you will be needed to submit. The BE form is for individuals who do not have any business sources. This is the most common form that is used by those who earn a monthly salary. The B Form is for individuals who own a business. The M form is for non-residents who are working with a monthly salary. This refers to individuals who are not citizens while he MT form is for those who own a business in Malaysia. The P Form meanwhile is meant for those who are in a partnership business.

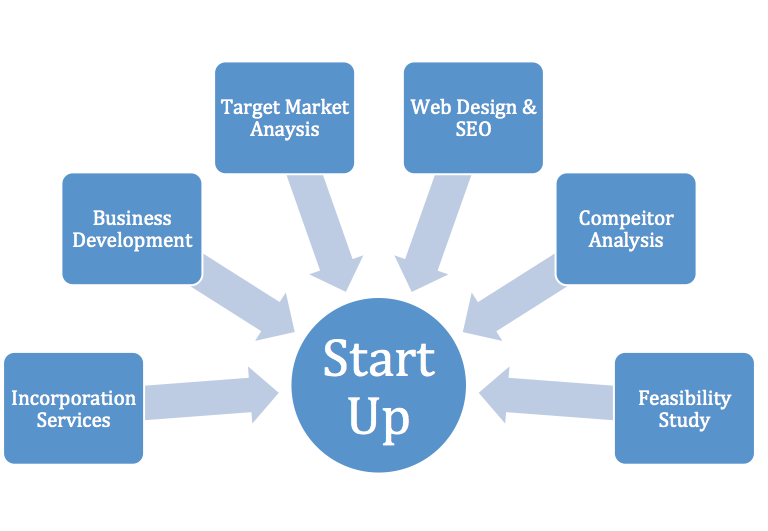

Our services included:

1. Personal tax planning in Malaysia and submission of personal & business income tax

2. Malaysia Enterprises tax planning, preparation and submission of company tax returns

3. Multilateral trade tax planning

4. Accounting, auditing and tax preparation

5. Minimization of tax liabilities

For further queries, you are welcome to contact ATAHK anytime, anywhere by simply visiting ATAHK’s website www.3737580.net, or calling at +603-21418908 or email us at tannetcom88@gmail.com